by Ryan Brukardt, Jesse Klempner and Brooke Stokes

Interest in building and launching commercial satellite constellations continues to be high because of recent technological advances and cost reductions, combined with better access to capital. While some industry analysts feared that private investment in the space sector would plummet from the record highs achieved in 2021, the decrease in 2022 was less severe than expected and capital inflows were the second-highest on record. Excitement about commercial satellite constellations spans multiple sectors, with companies exploring wide-ranging use cases, ranging from national security to climate monitoring, to improve life on Earth.

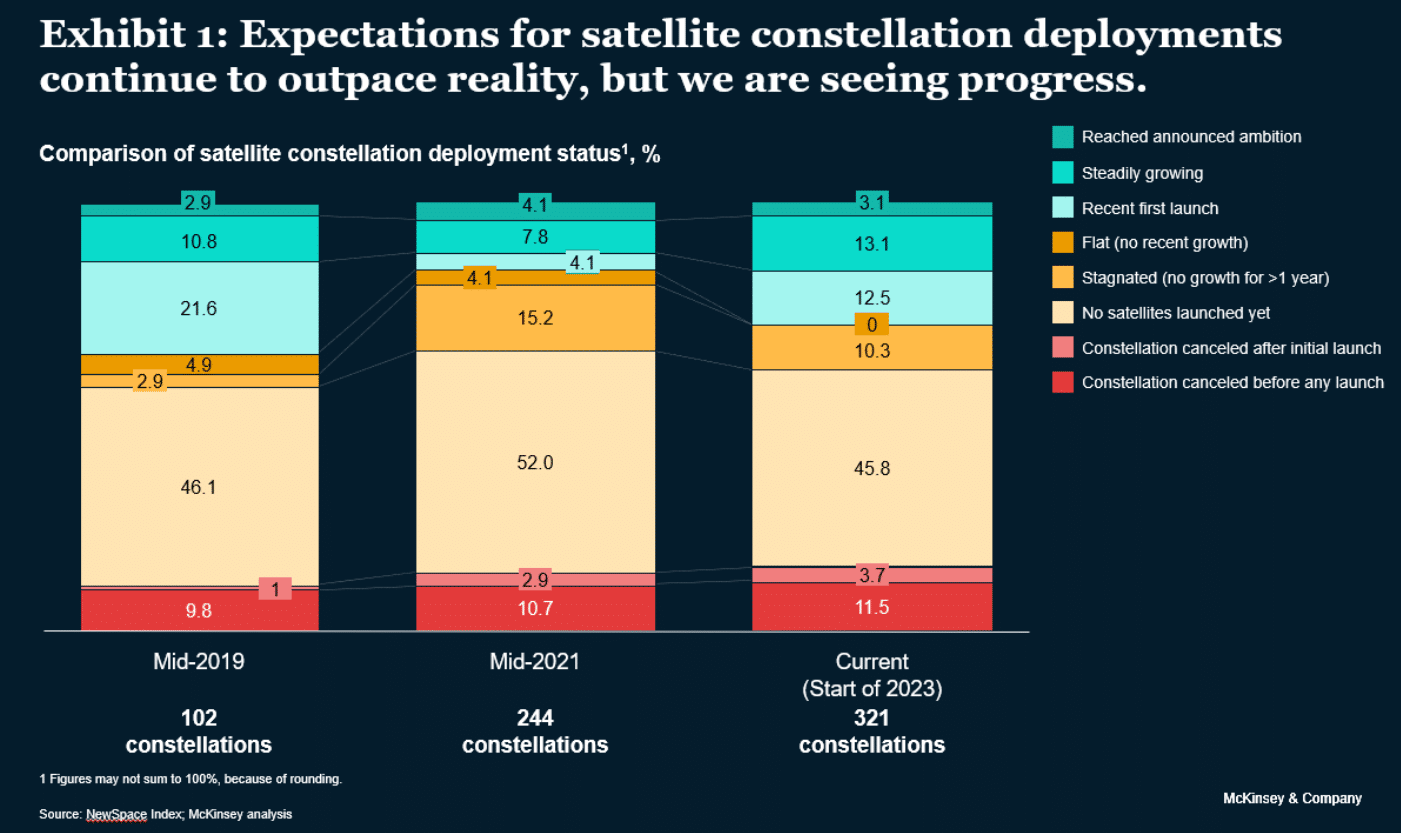

In 2021, we conducted an analysis to determine if constellation operators were able to translate their ambitious plans for satellite count and launch into reality. The results showed that operators had not yet placed an asset in orbit in more than half of the announced constellations. We conducted an updated analysis in early 2023 to determine whether interest in satellite constellations remains strong and whether operators are now more successful in achieving their goals. Three findings stand out:

- Interest in the sector continues to grow. The number of announced satellite constellations is now well over 300, up from about 250 in mid-2019.

- Reality continues to lag expectations. For announced constellations, about 45 percent have not yet had a single satellite launch and about 10 percent have stagnant growth, defined as no launches for more than a year.

- Positive momentum is growing. Although many operators have experienced little growth, nearly 30 percent of constellations did launch satellites over the past year, compared with only about 15 percent in mid-2021.

Many commercial satellite operators are still creating overly ambitious plans, but more companies are now making steady progress toward their launch goals.

The continued enthusiasm for commercial satellite constellations is encouraging, but it often results in plans that exceed what operators can reasonably accomplish, given development timelines, customer demand, and available capital. Some companies are emerging as leaders, however, despite the fact that capital is not as readily available as it was a couple of years ago. These businesses create well-articulated, data-backed plans that describe how they can increase customer demand for satellite offerings, and their solid preparation may help them obtain the capital required to achieve their constellation goals. After a funding round, their continued progress in launching satellites encourages further investment, since it provides proof of their commitment and capabilities.

For the remainder of 2023, we anticipate that current constellations, including megaconstellations in non-geosynchronous orbit that enable communications, will continue to make progress and that some new ones will emerge. Simultaneously, the number of constellations that are canceled, either through a formal announcement or simply by not making progress, will also increase. Industry entrepreneurs who follow these developments may gain insight into the factors that set successful constellations apart from the rest.

Ryan Brukardt is a senior partner in McKinsey’s Miami office, Jesse Klempner is a partner in the Washington, DC, office, and Brooke Stokes is a partner in the Southern California office.